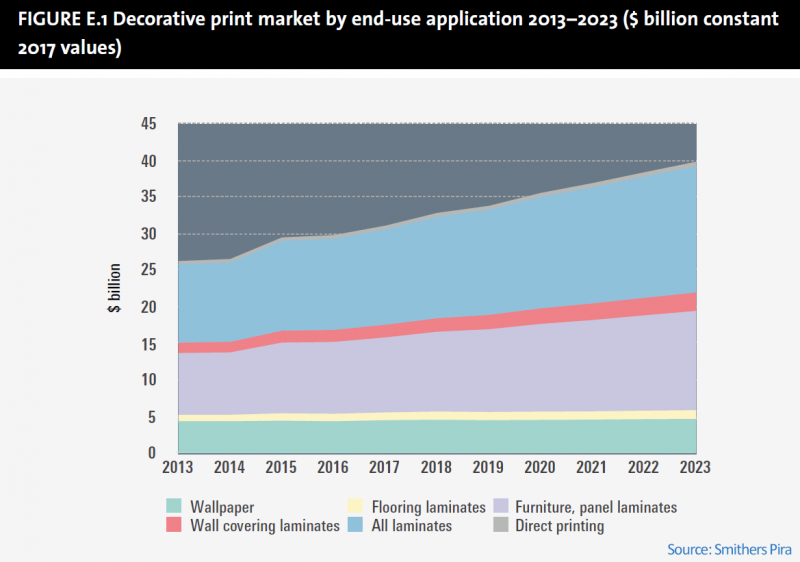

Annual growth rate of 5% forecasted from 2018 to 2023.

The decorative print market is growing as consumers look to enhance the aesthetics of their homes and businesses.

Decorative printing volume is almost 13.1 billion square metres in 2018, with a value of more than $18.9 billion. New Smithers Pira research – The Future of Decorative Printing to 2023– forecasts the market to grow 5% annually from 2018 to 2023. This covers a range of new and traditional processes and materials. Smithers analysis segments the market for:

Wallpaper

Flooring laminates

Furniture, panel laminates

Wallcovering laminates

Direct printing of objects, like panels, doors and sundry objects including glass screens and switches, knobs, buttons and dials.

Gravure printing is the biggest process in decorative printing, accounting for 83.6% of print volumes in 2018, with a little less of the value at 80.5%. Inkjet is the fastest growing process, increasing from 4.1% of the print value in 2013 to 13.8% by 2023.

The decorative print market is growing, ultimately because more people have enough money to improve their living environments while owners of businesses and public buildings wish to improve the public perception and approval of their premises. The four main trends driving this growth are:

The encouragement to keep up with the latest fashion trends

In hospitality – the impetus to create an immersive experience for the brand

The increase in new homes being built

Competition with traditional natural materials, like wood flooring

Fashion trends

The choice of materials used to decorate living spaces is largely a matter of personal taste, and the industry encourages regular updating to counteract wear and tear or in accordance with changing design and household trends. Furniture replacement and upgrading underpins demand, with less regular upgrades and refurbishment of kitchens and bathrooms creating demand. This is critical for large public buildings in hospitality, where hotels, restaurants, bars and shops will redecorate to appeal to consumers.

The ever increasing exposure to luxury homes and workspaces showcased via TV makeover programmes or celebrity photoshoots, demonstrates the latest trends in décor. Retailers will introduce new ranges and interior designers pronounce the colours, materials and styles that are ‘en vogue’. Consumers follow these sources and this drives adoption of wallcoverings, flooring and furniture, leading to demand for decorative print.

Hospitality

Decorative printing is becoming an increasingly important tool in the development of a brand. Particular businesses that capitalizing on this are:

Coffee shops

Cafes

Bars

Pubs

Hotels

Entertainment venues

Transport hubs

The sign on the door is no longer enough – there are recognised colour schemes and now flooring, table tops, chairs and wallcoverings may be printed to follow the corporate brand. Visual prompts help create an immersive experience for the brand and hopefully generate consumer approval and goodwill along with a pleasant, coordinated environment. This is an important market for decorative printing, as companies rebrand to keep their public spaces fresh and ahead of their competition.

Growth in housing and increasing urbanisation

A key driver for décor print is the increase in homes, which is driving demand for new and replacement wallpaper, fixtures, fittings and furniture. More homes results in more people making choices and potentially redecorating.

As personal incomes rise in developing areas, individuals will be able to dedicate more money to purchasing furniture. Increasing urban population is one of the strong impacting factors affecting the home décor market.

Due to growing urban populations, living spaces are becoming smaller and more expensive. Even though more and more buildings are being constructed, people will have to continuously take into consideration how interior design can work and look in the smallest of spaces.

Homeowners will find ways to optimise their property through smart divisions and space-saving furniture, boosting demand for decorative printing.

Natural raw materials compared with printed décor

The cost and availability of raw materials play a vital role in the home décor market. At the premium end of the market, it is fashionable in Western Europe to use stone slabs for kitchen work surfaces. The premium segment lost volume from 2008 to 2012 due to the economic downturn, losing share to decorative paper and laminates which have grown strongly.

Solid wood is also very widely used: in some markets it is a traditional and low-cost material. In some markets oak is widely available and medium priced; in others oak is rare and premium priced. For most applications in the home, solid natural wood is widely regarded as the highest quality choice, regardless of the price category involved.

By 2020 it is forecast that the cost of raw materials such as plastic and glass would decrease, owing to advancements in production technology of these raw materials.

This creates a market opportunity for printed laminate alternatives, especially on digital systems which are increasingly better able to recreate the complexity and variability – for example a natural looking wood grain – seen in natural materials. For the home decoration market printed laminates offer several advantages, besides reduced raw material costs, including lower weight, and being easier to clean.

Source: Smithers Pira